Bitcoin Is Neither Cash Nor Cash

Bitcoin Is Neither Cash Nor Cash - Chapter[2.1] R[5-10]

This is Chapter[2.1] of our exploration on 'Bitcoin is trick and misrepresentation'. Find how Bitcoin bombs in all significant attributes of cash and money.

Reason[5]: Bitcoin has No Inborn Worth

Fiat supposed monetary standards, for example, USD and Bitcoins have ZERO Inborn worth, and that implies that you can not involve them for whatever else besides as a purported fractional vehicle of trade. You can't eat paper or bitcoins, you can't make instruments utilizing them, you can't involve them for any modern reason dissimilar to Gold or Silver. In their valid, unique, physical or virtual structure all government issued types of money have no intrinsic worth with the exception of the speculative trust work according to the onlookers.

Bitcoin devotees contend that even Gold has no inherent worth. Simply a stone group treat as valuable in view of the trust individuals have expand upon it north of thousand of years. I have proactively made sense of how silly this believing is, which is an obvious evidence of how programmed and entranced bitcoin local area is. Peruse these 10 motivations behind why Gold is so important.

Without Gold and Silver, bitcoin mining would have been recently a fantasy!

. It ought to be a solid and non-fluctuating unit of measure

to pass judgment on the worth of things.

At the point when you purchase something from a supermarket

or shopping center, you see sticker prices referenced on every thing. This

would have been incomprehensible on the off chance that paper The fluctuating

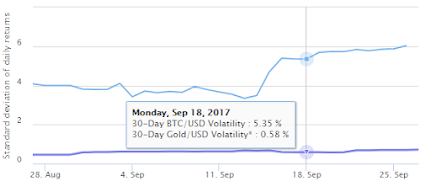

line (Bitcoin) when contrasted with the practically steady line (Gold) in the

graph above is sufficient a proof of how unstable bitcoin is.

The outline above shows the Gold Versus Bitcoin

unpredictability in USD for a multi day length between Aug-Sep 2017. You can

obviously see that bitcoin is multiple times more unstable than Gold, all in

all it is multiple times more hazardous to put resources into Bitcoin

contrasted with Gold.

Bitcoin is without a doubt the most unstable cash at any

point presented that is not really a store of significant worth and whose

establishment can shake with smallest media hypothesis as happened as of late

when JP Morgan President called "Bitcoin is a Fake" and China

prohibited all Bitcoin trades.

This made Bitcoin costs fall by 20% and Ethereum costs to

fall by 30% inside only three days. Making a lose of $30 billions digital money

local area!

Reason[7]: Bitcoin isn't a 'Unit Of Record'

A unit of record should have a steady worth for example

ought to be nonvolatilemonetary forms were just about as unstable as bitcoin

today. Bitcoin esteem changes with an unpredictability pace of 6% as we examined

before. It is so speculative in nature exclusively founded on prearranged

bitcoin forecast for example it can free 30% of its worth soon. Any individual

who will sell things on the web or disconnected with bitcoins will either

experience a 6% misfortune or gain on each product.

In the event that a thing in a bitcoin-tolerating store

costs $100 during morning, it could cost $95 during night or $105 during night

or $70 the following day! You can never have a decent cost with bitcoin. I

don't know whether any reasonable retailor would face such a challenge.

How in the world could anybody at any point consider it a

unit of record when you couldn't in fact label the costs of day to day staple

things with bitcoin? Truly talking there are no bitcoin clients at all who use

it as a cash, nearly everybody is simply holding it or exchanging it.

Online retailers that statement in Bitcoin normally update

at extremely high recurrence to keep up with stable costs in customary monetary

standards like US dollars.

This reality is very much made sense of by a reasonable

bitcoin client himself who cherishes the blockchain innovation however isn't

dazed by the lies of Bitcoin intellectuals. The Gulden lead engineer, Malcolm

MacLeod, who when asked by Cointelegraph on the off chance that bitcoin is

really utilized as a money in the commercial center, he answered:

"I think not,

I attempted to purchase something with Bitcoin yesterday (June, 2017) on a well

known retail site and the exchange planned out two times. I struggle with

accepting anybody is involving it for something besides exchanging and

hypothesis at the present time."

— Gulden lead

engineer, Malcolm MacLeod

Reason[8]: Bitcoin Is a Theory not Cash or Speculation

Hypothesis is the acquisition of a resource with an

expectation or mystery or forecast that it will become important sometime not

too far off. It is likewise the act of participating in dangerous monetary

exchanges trying to benefit from transient changes.

Bitcoin today is scarcely utilized as a money to purchase an

item or administration (with the exception of crimes) because of its

practically immaterial trader support or slow handling and exchange break

issues. It is utilized for no good reason aside from exchanging and theory.

The focal point of bitcoin purchaser and merchant isn't as

much on the side of blockchain innovation or on the convenience of bitcoins

however much it is in its cost developments. They are all in a dash for unheard

of wealth and occupied with purchasing in bitcoins due to a 'feeling of dread

toward passing up a major opportunity'.

Superstars and traditional press is utilized massively today

to make a feeling of trust and believability in bitcoin market (subtleties

here). Following are a few enchanted explanations that are utilized to

mesmerize new adopters of bitcoin:

"Get it

today else you will lament tomorrow"

"On the

off chance that you had purchased bitcoins one year prior, you would have

turned into a mogul today"

"You will

be a moronic, in the event that you don't buy bitcoin today"

"Purchase

bitcoin today and say thanks to me following a year"

As exhibited by Warren Buffett (American industry financial backer), purchasing bitcoin isn't invesment at any rate clear hypothesis that is something almost identical than betting where you purchase something accepting that the going with individual will pay you something else for your futile pieces.

In a get-together given to Hooray Money on 28th April, 2018, Warren Smorgasbord said absolutely that Bitcoin is just a bet and speculation:

One is genuinely a financial game plan, while the other isn't, "there are two different types of products that folks buy and realise are financially responsible."

As shown by bitcoin, Buffett, isn't.

Expecting you to purchase an unusual in a firm, a level, or an endowment... You may carry out that on a secret justification. And it's a completely ethical undertaking. You take a gander at the veritable speculation to convey the re-appearance of you. At this point, expecting you purchase something like bitcoin or some cryptographic money, you don't actually have whatever has made anything. You're essentially trusting the going with individual pays more."

Precisely when you purchase cryptographic money, Buffett proceeds, "You're not financial organizing when that is your strength. You're speculating. It checks out. To bet another person will come and pay more cash tomorrow, that is one sort of game. That isn't cash the board."

— Warren Smorgasbord

Taking into account this thoroughly clear partition made by Smorgasbord, obviously the whole electronic money market is basically only a solitary high stakes bet that can go without a doubt.

Reason[9]: Bitcoin Isn't Critical

Individuals who handle the chance of flood or cash truly have faith in the canny saying:

"You don't make promises you know you won't be able to keep,"

Bitcoin is a virtual money and it has no presence in genuine or genuine plan since it is maintained by nothing, not even the phony confidence in some association. You can't arrive at it nor could you whenever see it. Taking everything into account, during monetary emergency or war emergency, bitcoin is immaterial without web or electric power.

Bitcoin is made/mined utilizing a thing advancement. It exists in state of the art structure and are dealt with in mechanized wallets. All your financial advancement is accommodatingly completed trades or wallet associations. Your destiny relies on a tick of a button.

What else might have the first rate longed for than a money related framework through which they could follow minute-to-minute improvement of everyone. You can not mask your flood from appalling government charges in future.

Might you whenever eventually decide to reside in such a credit just economy where your chance and security will be composed by electronic things maintained by nothing?

Reason[10]: Bitcoin Is Vain Without Power and Web

The best disarray that bitcoin clients have is that they see the future how its portrayed in hollywood motion pictures like Star Outing or Star Battles with flying planes rather than vehicles, space suits rather than materials and peculiarities instead of people. For them what's to come is all contraptions, reliably persisting through elective wellsprings of energy, no impact setback and no battles..

This is absolutely exact thing individuals of Afghanistan, Iraq, Syria, North Africa and Libya could have envisioned moreover.

How valuable normal assets are squandered in air to mine digital currencies today is alaraming. Briefly consider the whole world being credit only. Individuals exchanging with each other utilizing cryptographic forms of money.

How would you feel during Christmas, Eid or Diwali when all of you race to ATMs to cash out assets and you find that the ATM administration is right now not accessible?

How would you feel when you need to endure long stretches of burden shedding because of deficiency of force supply during summers?

How would you feel when a retailor tells you "Sorry sir we can't acknowledge Visas as we just lost web access.."

I'm certain it pisses you yet to some extent some way or another you will oversee thanks to some money investment funds at home yet how might you oversee assuming that the sum total of what you had was digital currencies? How might you shop fundamental necessacities of life without any power and web?

Assuming sweden is hit by a quake and all its forces to be reckoned with get imploded, how might the residents purchase labor and products in such condition given that sweden is practically credit only?

All answers take you back to a substantial, strong and defelationary item that might guarantee stable business and exchange every single startling situation. Nothing qualifies better compared to gold and silver. A cash that has natural worth and doesn't vanish without any power or web.

Lets overlook most pessimistic scenario situations like conflicts or regular disastors and on second thought examine what is more conceivable and happens consistently all over the planet for example Power outage.

Be that the blackout in the accompanying nations which affected large number of individuals:

2012 India power outage, 620 million affected

2015 Pakistan power outage, 140 million

2014 Bangladesh power outage, 150 million

2015 Turkey power outage, 70 million

2003 Upper east power outage in USA and Canada, 55 million

the rundown goes on.....

Envision this multitude of nations becoming 100 percent credit only, what might you see in the city during a power outage when a huge number of individuals will not have the option to trade food and prescriptions in return for a cryptographic money? Nothing large as per crypto-admirers except for brutality, carnage and disarray..

Consequently Bitcoin turns out to be totally pointless when the organization is disconnected or out of reach. Bitcoin is reliant soley on worldwide correspondence organizations and predictable power supply. On the off chance that you switch off the switches and transformers, bitcoin is dead.

A computerized cash really does possibly seem OK in the event that it is supported by gold stores which are consistently evaluated under severe governement guideline and the general population having open admittance to the aduit reports.

In such case regardless of whether whole cash is hacked or web goes off, the public won't fail as they will in any case approach the actual gold which they can guarantee whenever utilizing their computerized IDs whose reinforcement will in any case exist on a few government servers on the web or disconnected.

Comments

Post a Comment